The blog will help you understand the basic concept of a Neo Bank app and the stages of its development.

What is the Neobank App? (with examples)

How Does the Neobanking App Work?

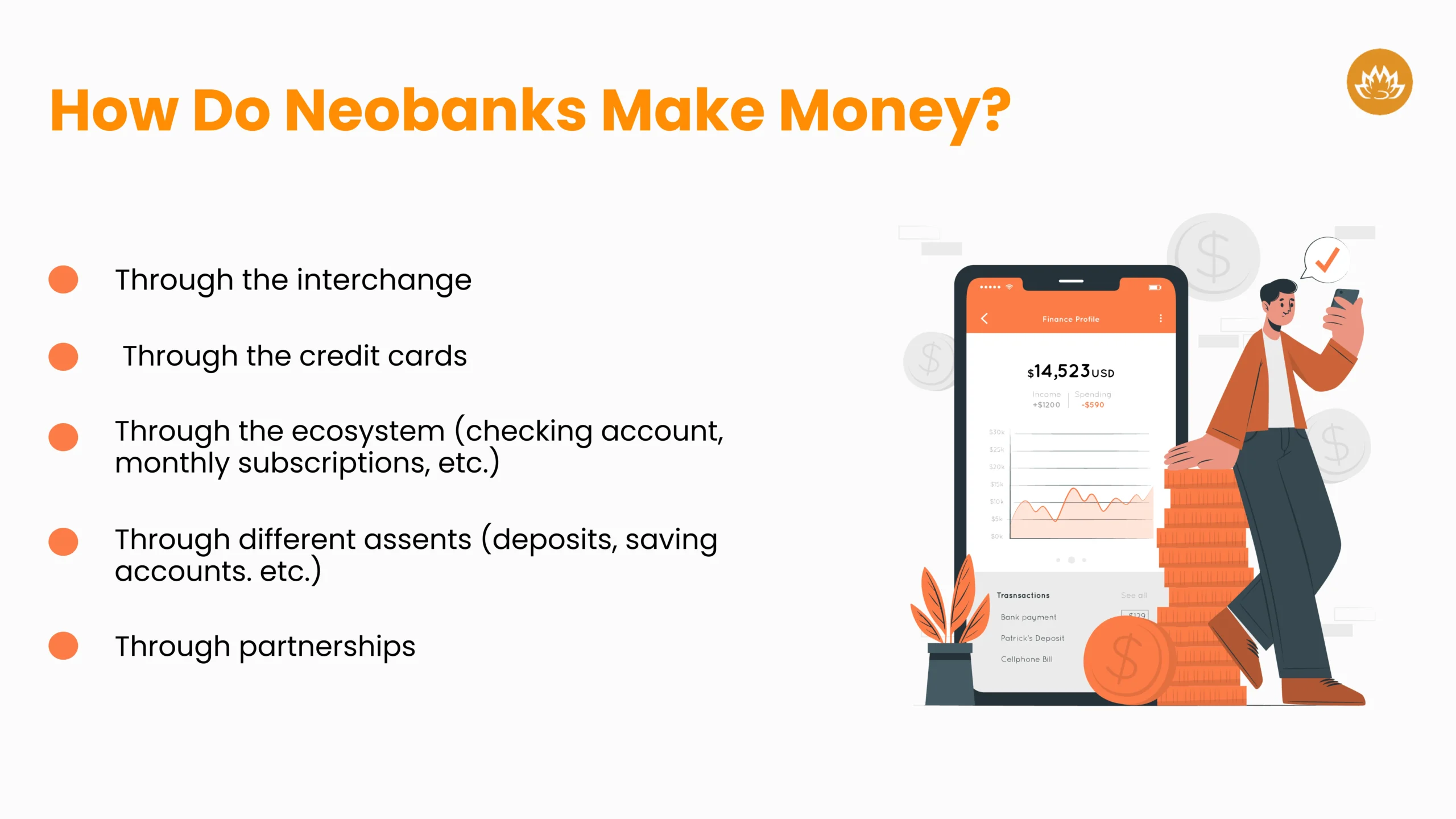

How Neobanks Make Money?

Neobank apps can earn profits by practicing the five business models below.

Interchange Model

It sources revenue through interchange every time customers pay with Neobank’s card.

Credit card Model

Ecosystem Model

Through checking account systems, it provides other types of monetization strategies like monthly subscriptions, etc.

Asset Model

Product Extensions Model

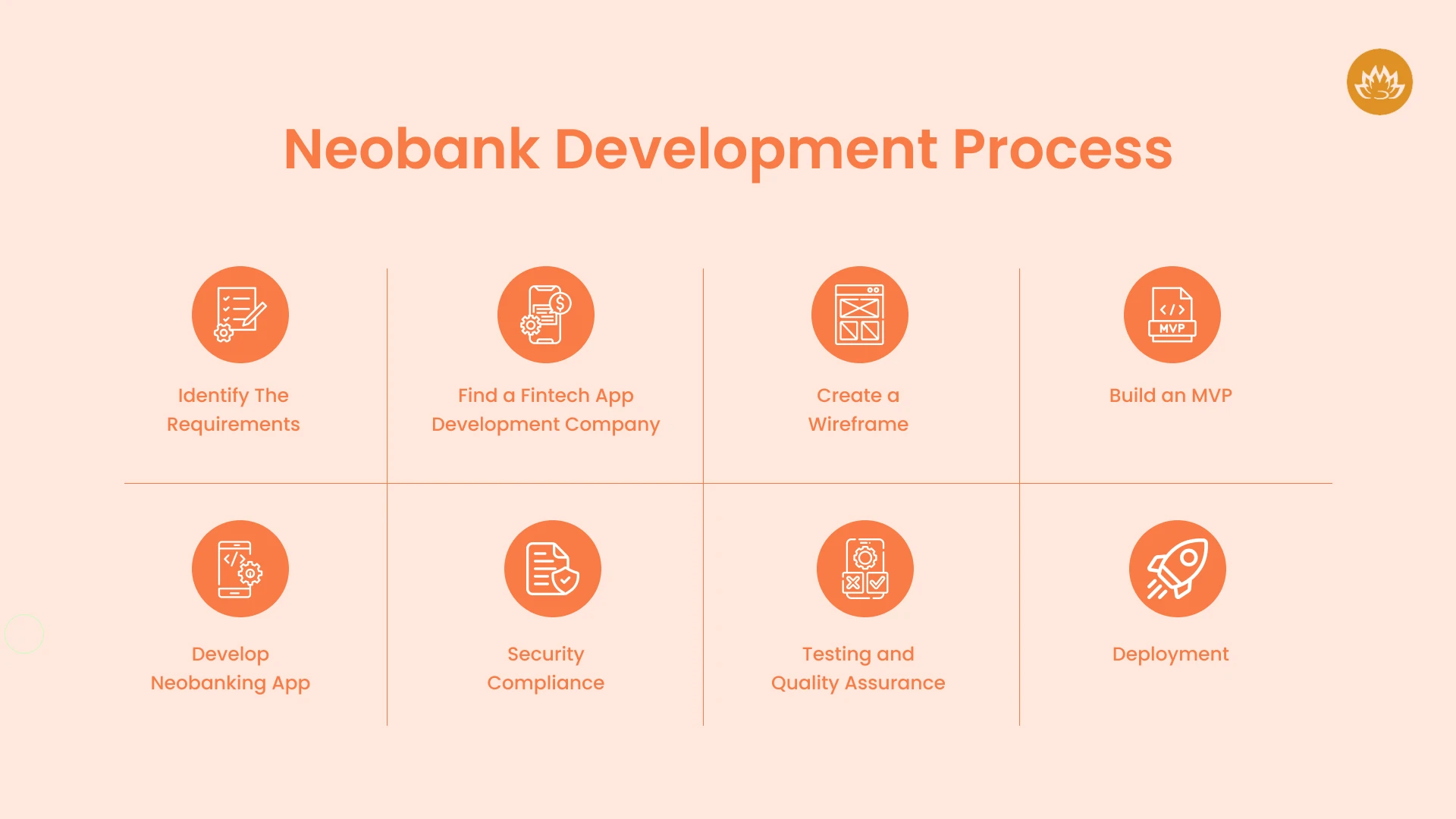

How To Create A Neobanking App?

To create a robust Neo banking app for your target audience, you can always approach a company providing high-quality mobile app development services. Here is a step-by-step guide for Neo banking app development.

Identify The Requirements

Find a Fintech App Development Company

Create a Wireframe

Build an MVP

Develop Neobanking App

Security Compliance

Testing and Quality Assurance

Deployment

The Top Features of Neobanking Apps

Account Opening

Multiple Payment Options

Card Management

Online Lending

Expense Tracker and Budget Tool

Real-Time Fraud Detection

Gamification

Push Notifications

Generative AI-Powered Chatbot

Conclusion

Author

-

Sunil is a result-orientated Chief Technology Officer with over a decade of deep technical experience delivering solutions to startups, entrepreneurs, and enterprises across the globe. Have led large-scale projects in mobile and web applications using technologies such as React Native, Flutter, Laravel, MEAN and MERN stack development.

View all posts