Interested in knowing how much it costs to build a Fintech app? Over the decade, Fintech apps have gained fame in the market. Fintech revenue is estimated to grow up to 188 bn euros in 2024. As an entrepreneur, if you have decided to build a high-performing Fintech app for your target audience, you must ensure it has the new-edge features to beat your competitors. Another research reveals that about 96% of millennials use fintech products, twice as much as baby boomers.

Hence, you can build various fintech apps, from simple budgeting tools to complicated investment apps. The blog sheds light on the most common worry fintech app startups have: how much is the cost of building a fintech app? Well, no one can finalize the fixed cost of developing a fintech app. However, to answer this most sought-after question, we can help you know the factors that will influence the overall budget and the cost estimation for various app complexities.

What is a Fintech App?

Fintech App (Financial Technology application) facilitates providing financial services in a seamless, secure, and efficient manner through a mobile device. It is a software program that offers numerous features to help you easily manage your money and perform financial transactions on the move. Nowadays, several fintech startups partner with mobile app development companies to build intuitive fintech applications.

Some top functions of Fintech apps are mobile banking, payment processing, investment, personal finance management, and cryptocurrency trading. Fintech apps have become inevitable in people’s lives. Some of the most common fintech apps you must have known are Venmo – an app for users to send and receive money quickly; Robinhood – an investment platform to buy and sell stocks, ETFs, and options; and SoFi – an app offering loans for multiple purposes. So, before you begin your development process, be wise enough first to understand the estimated cost of building your dream app.

What is the Cost of Building a Fintech App

A lot of factors influence the cost of building a fintech app. These can include features, functionalities, target audience, and much more. However, as an expert Fintech app development company, we can provide you with a rough range that can be just a starting point.

If you want to develop a fintech app in 2024, the estimated cost can be around $30000 to $300000. The large gap between these two figures is because they cover various factors determining the exact cost. Generally, the price is determined based on the app’s complexity. The detailed explanation is as follows:

-

Basic App - Starts from $50000. It includes simple features like expense tracking and financial goal-setting

-

Average App - Prices start from $10000 - $30000. It includes a mobile banking app with features like bill payments, account management, and money transfer.

-

Complex App - Starts from $300000. Such apps provide high-graded features like cryptocurrency trading platforms or robo-advisors. They use complex back-end technologies and frameworks embedded with AI or blockchain.

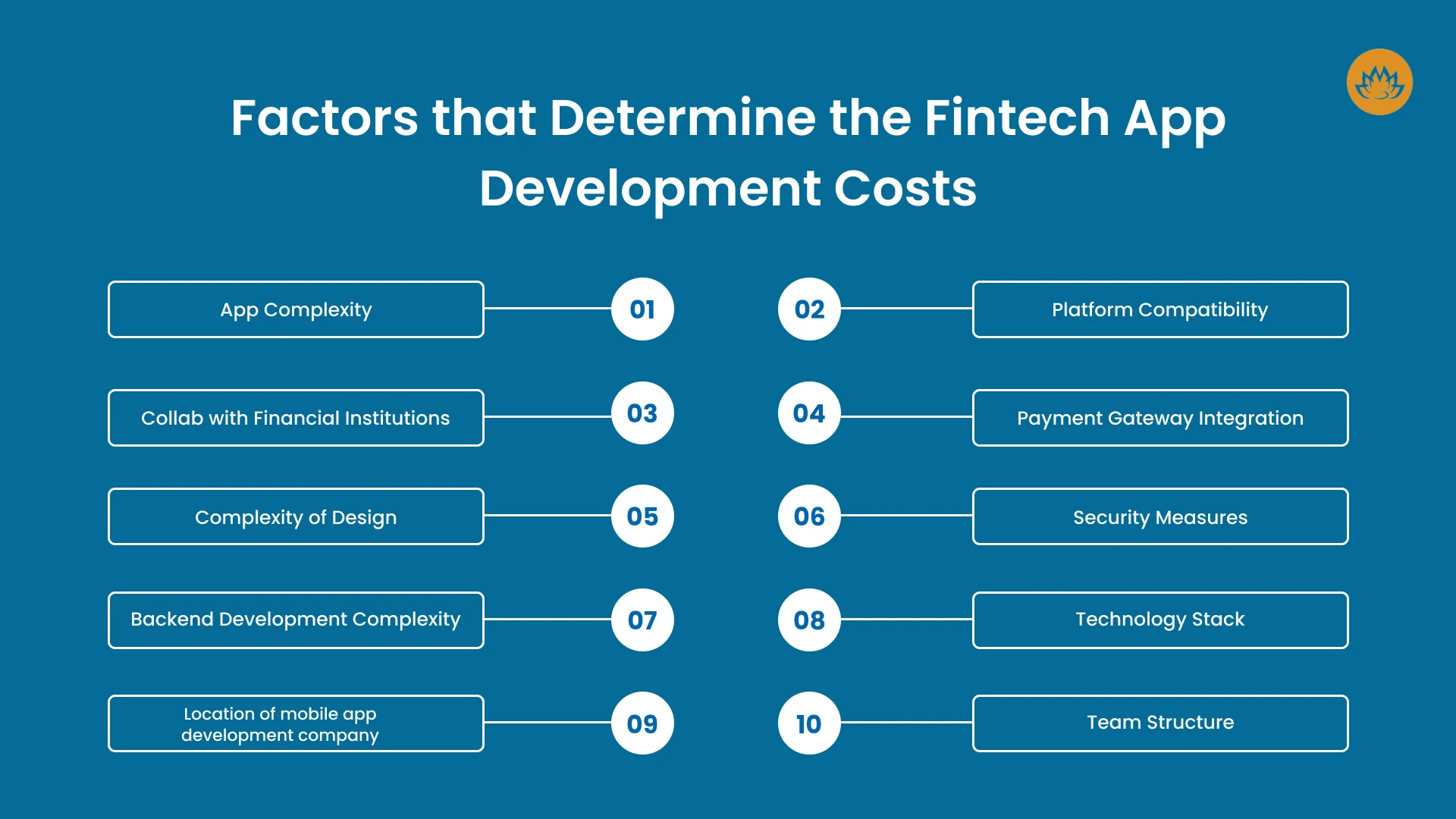

Factors that Influence the Cost of Building a Fintech App

Of several factors that may influence the cost of building a fintech app, the most influential factors are listed below.

If you want to develop a fintech app in 2024, the estimated cost can be around $30000 to $300000. The large gap between these two figures is because they cover various factors determining the exact cost. Generally, the price is determined based on the app’s complexity. The detailed explanation is as follows:

App Complexity

Adding more complex features to your app can take longer development time and raise costs. However, if you want your fintech app to have simple features like user log in, expense tracking, and basic calculations, it can be developed at lower costs and with less effort.

However, to build a complex, featured app that includes real-time stock quotes and blockchain integrations, advanced development skills would be needed, which will lead to higher costs.

Platform Compatibility

If you develop a fintech app for a single platform, it will be cheaper as the team needs to focus on a single codebase. However, if you choose to develop your app for multiple platforms, it requires separate versions, or you can use cross-platform development tools. For this, the cost may go higher.

Complexity of Design

Fintech apps that appeal to users have powerful and intuitive UI/UX design elements. Design complexity is another element that determines the costs. For example, if you wish to have simple designs with standard UI elements, the price is less as it does not take more time and resources to make a design. However, you may need complex animations or interactions that involve higher costs to create a unique design with a powerful custom user interface.

Security Measures

Fintech apps that use standardized basic security tools, such as username/password authentication, are less expensive. Implementing advanced security features like secure API connections, biometric authentication, etc., can be more expensive. In addition, data encryption and privacy measures are added features that also impact pricing. Various encryption protocols for user data security are cheaper than integrating enhanced encryption with advanced algorithms.

Collab with Financial Institutions

As a Fintech app startup, you must ensure your app is well-integrated with external financial services to perform basic financial transactions at no extra cost. However, adding advanced integrations with multiple banks, payment gateways, or investment platforms can cost more.

Payment Gateway Integration

Payment gateway integration, such as Braintree, Paypal, or Stripe, is an essential element that determines the cost of fintech app development. The most important integration that supports standard payment methods is less expensive than advanced integration. Basic integration includes wire transfers, credit cards, etc. Advanced integration includes payment options, subscription models, and cryptocurrency financial transactions.

Backend Development Complexity

Backend development complexity is an essential factor in determining the cost of fintech app development. A simple backend infrastructure, such as primary server setup and database management, will be less expensive. However, a complex backend designed for handling extensive data and user interactions will be costlier.

Technology Stack

What kind of technology stack you choose also plays a crucial role in fintech app development costs. Standard technologies like common programming languages and frameworks can cost less, while using emerging technologies such as AI in fintech, blockchain app development, etc., can cost much more.

Location of mobile app development company

The geographical location of the mobile app development company greatly influences costs. If you hire local app developers with higher labor costs, you may pay more than if you hire an offshore development team. If you hire fintech app developers from the US, it costs around $100 – $200 per hour. Alternatively, if you hire dedicated developers from Asian countries, it comes down to $50 – $80 per hour.

Team Structure

The overall structure of the development team influences as well. A team comprising top professionals and well-experienced developers with diverse skill sets involving how to develop MVP and practice an agile approach, etc., may cost more than hiring a regular team of developers. Moreover, the range of roles that you hire also matters. For example, to develop a successful fintech app for your startup, you may need various roles such as project manager, business analyst, solution architect, developer, UI/UX design expert, QA engineer, and DevOps.

How to Grow Your Fintech App into a Success

Growing a successful Fintech app that thrives in the competition and can attract users needs some essential tips to follow:

-

Identify the specific pain point and convert it into your niche, tailoring your app to find a relevant solution

-

Always prioritize user experiences and build a more intuitive and user-friendly app

-

Build utmost trust among users by ensuring compliance with various security measures and data security practices

-

Execute an extensive marketing strategy to reach your target audience

-

Seek user feedback through surveys, reviews, and communication tools to identify areas of improvement.

-

Deliver excellent customer support with a responsive and trusted user interface

Conclusion

At Whitelotus Corporation, we have the best fintech app development solutions for trading platforms, cryptocurrency platforms, digital wallets, etc. We are the most reputed Fintech software development company with over 12 years of domain expertise covering various banks, financial institutions, and establishments. We have helped our clients improve transaction security, automate processes, and enhance finance and banking operations with our hi-tech and modern Fintech app development solutions. We use the best technologies and tools to create robust Fintech apps at affordable costs. Visit us at our website or talk to our experts for further discussion.

Author

-

Sunil is a result-orientated Chief Technology Officer with over a decade of deep technical experience delivering solutions to startups, entrepreneurs, and enterprises across the globe. Have led large-scale projects in mobile and web applications using technologies such as React Native, Flutter, Laravel, MEAN and MERN stack development.

View all posts