Do you know some of the top challenges currently hampering the progress of banking sector to a large extent? The rising security concerns, demand for real-time data accessibility, and compliance complexities are the biggest hurdles banks face today.

Customer expectations are constantly evolving. Here comes the role of fintech disruptors who are finding ways to break traditional banking patterns and provide secured digital services to customers. The essence of the blog will remain in exploring the role of enterprise software development in transforming banking operations. Financial software has become a savior for banks in streamlining processes, improving security measures, and offering diverse digital services.

If banks want to overcome challenges, they must partner with proficient software development services. Experienced software development company can add value beyond digitalization, deliver enhanced operational efficiency, give better customer experiences, and improve the capacity to withstand future challenges.

The blog will equip banking experts and stakeholders with insights and will empower them digitally.

What does enterprise software do for banks?

The year 2026 will see a sharp growth of up to $66.02 billion in the market size of the BFSI sector. Enterprise software is one of the emerging technologies in the banking sector. Customers can connect with their own bank branches from remote locations. With multi-channel banking software, they can complete their transactions either through the Internet, mobile, or branch.

The software provides convenience to the customers, increasing the bank’s customer base and fulfilling their needs. All this leads to the fact that there is not a single person in the world who doesn’t know the value of mobile banking and Internet banking. Today, people who preferred traditional banking before, are now learning modern ways to interact with mobile banking applications. The apps come with high-security mechanisms. A lot of banking institutions nowadays are finding options to hire remote developers and join the benefits that banking software provides to users.

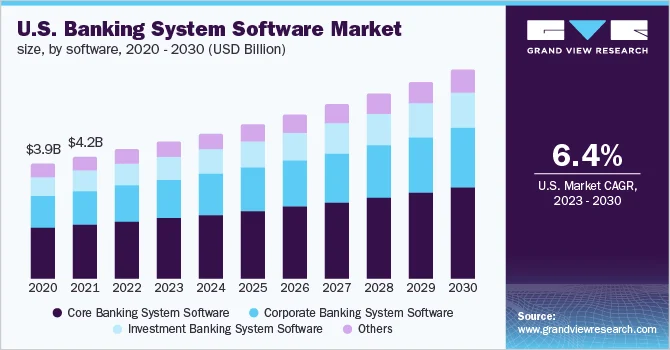

Banking system software market size is rising consistently with a $35.88 bn valuation in 2022 to an expected growth of 6.4% CAGR till 2030.

Benefits of Banking Software & Mobile Banking Applications

Nowadays, banks want high-quality software to make the lives of users easy and comfortable. The emerging technologies in the banking sector empower these institutions, equipping them with top-notch solutions. Some of the major benefits of using banking software are:

- Cost-efficient ways to minimize operating expenditure by technology integration.

- Regulatory compliance and security practices

- Quick delivery timelines enabling efficient client services

- Offering banking solutions on the go

- Providing competitive advantage

- Higher team productivity

- Develop customer trust with a multi-channel communication approach

Types of Software Banks Use

Banks can use different types of software for their banking operations. Some of the known kinds of software are:

- Software to manage financial operations.

- Administrative management software

- Document management software

- Customer service solutions.

Software to manage financial operations

This software has below features:

- Balanced scorecard system

- Management Accounting

- Financial resources transfer management

- Financial planning and budgeting

- Consolidated financial statement management

The software also provides different variety of tools to help bank authorities in doing processes like budgeting, planning, and management accounting. It provides better transparency in the entire banking system, enabling managers to respond in coordination with stakeholders.

Administrative management software

Managers can manage bank efficiently with this software and can handle the overall administration of the bank. It includes various areas like:

- Materials management

- Sales management

- Budgeting

- Accounting

- Cost control

- Purchase management

- Payroll management

- Personnel management

With this software, banks can perform seamless administrative tasks with efficiency. It helps banks save numerous hours for various other productive tasks. Managers can take up high-priority projects.

Document management software

The software can save a lot of paper, easing the process of document management. By automating tedious procedures, the software can compile memos, loan papers, administrative reports, customer KYC documents, etc. In addition, mobile banking applications help customers to upload their documents easily.

Customer service solutions

Banking system CRMs combine modules, ensuring seamless banking interactions with the customers. The systems typically include a marketing module, customer background information, and a banking automation module. Moreover, the software integrates various stages of interaction that start from converting customers to banking to after-sale services. These systems can identify user pain points and provide solutions to improve the communication process as per the analytic reports. Banks can deliver personalized service to clients, boosting engagements and elevating user experiences.

Banking Software Development Trends 2023-2024

Some of the biggest technological innovations will majorly impact in shaping the future of the banking industry. Banking software is going to adopt the below trends to empower banking operations and help these institutions work with topmost efficiency and productivity.

Contactless payments

- Microchip-enabled credit cards and debit cards

- No hassles to remember passcode

- Upgrading back-end for contactless payments

- Software that can update the balance in real-time with the tightest security measures.

Blockchain

- Getting rid of middlemen and decentralization with secured technology systems

- Making the process faster and cheaper

- Data storage for every transaction from inception to closure with water-tight security.

- Added security and transparency will help banks in efficient auditing and accounting.

Machine Learning

- Banking and Financial Services Industry are leaders in adopting latest technologies

- ML-based technologies are used in alternative credit decision-making systems to make correct decisions regarding loan disbursals.

- Machine learning algorithms to analyze customer data for predicting user needs and delivering products on time.

- With sophisticated ML algorithms, banks can collect and analyze customer’s data and predict their needs, providing products at the right time.

- Intelligent chatbots will be deployed to solve customer queries

- AI and ML technologies combined will help banks save trillions of costs.

Biometrics

- Integration of fingerprint authentication into banking systems

- Fingerprint sensors and biometric technologies like retina scanners, voice pattern scans, and face scans.

- Mobile banking applications developed with log-in options with biometrics to quickly register into the portal and get banking services.

Data Analytics

- It contains big data analytics, business intelligence, and advanced analytics to harness the efficiency of massive data generated by banks every second.

- Analyzing customer data at every touchpoint to deliver personalized services

- Performance dashboard and detailed compliance reports that establish the real scenario of financial institution

- Data-driven insights to promote products and services to the users.

Cloud Computing

- Banks will prefer cloud-native software development from the beginning to cloud migration, creating a stable database and inviting numerous opportunities.

- Simplifying data to give real-time accessibility, facilitating settlements without the need to sign the documents offline.

- Fraud detection programs to prevent data sharing for anti-money laundering.

ERP software

- Centralized system to manage data for all types of banking activities happening in all departments.

- Single source point to derive insightful data analytics, helping banks to enhance their services.

IoT technology

- Movement sensors, allowing executives to find branches having maximum number of visitors

- Camera and sensor installation at ATM, helping prevent fraud and forecasting of cash strategies.

Top Features Available in Banking Software

Enterprise software for banks must have basic features that fulfill the basic needs of the customers like opening new accounts, payment clearance, processing loans, processing cash deposits and withdrawals, and calculating interest rates.

Apart from the above-mentioned features, there are some advanced features that you must integrate into your banking software.

Advanced Security and Fraud Alerts

- Strict security measures to avoid cyber crimes and control the rising fraudulent costs.

- Integrating robust security systems with sign-in details encrypted with robust encryption standards.

- Fast and secure sign-in process that is less cumbersome and gives peace of mind.

- Smart and modern algorithms to detect fraudulent transactions.

- AI systems to assess millions of transactions and identify the pattern

- Alerting users and bankers to find out unusual transactions that may deviate from the normal patterns.

Support to P2P payments

- Allows customers to send money to another user’s account.

- Users would prefer reliable banking software for security and convenience

- Unline third-party vendors, this feature will help bank not to charge heavy price on payment transfer and facilitate seamless payments.

Smart Chatbots

- Personalized approach to providing extra customer service to clients.

- The Chatbot feature will help customers address their pain points and avoid waiting on telephonic queues to resolve queries.

- With simple questions and based on customer responses, the chatbot will answer their queries.

- Those queries that are not resolved will be assigned to a human customer care executive.

- Chat history will be available to the executive to understand the problem and the customer would not have to repeat the same issue again.

Voice-Assisted Banking Service

- 7 out of 10 customers prefer voice search for buying something online.

- Voice technology will become a crucial part of modern-day Banking apps and software.

- This feature is one of the futuristic technologies that banking institutions will adopt to provide security to users and enhance customer experiences.

- The feature will help customers in checking account balances and addressing basic customer queries.

Tracking Spending Habits

- Users can track their spending habits and can improve their patterns to promote more savings

- Allows users to set saving goals by analyzing customized charts that show the progress of the goal so far.

Bill Splitting

- To enable real-time payment facility, giving a boost to mobile banking applications.

- Facility for splitting entertainment costs, group gifts, trips, and others.

Cardless ATM access

- Permits users to withdraw cash without a card

- With a QR code and multi-factor authentication through a mobile app, users can connect and access ATMs without carrying cards in their wallets.

ATM Map online

- Integrated geolocation application that points out the nearby ATMs or bank branches.

- The feature also provides details of the ATM center on operating hours, currency exchange rates, and cash availability

Technology Stack for Creating Banking Software

If you want to hire mobile application developer for your banking institution, you must first of all choose the right technology stack. The chosen developer must have the proficiency to use the technologies and must be able to coordinate well between security and convenience. The below technology stack is a good option for developing your banking software:

Programming Language: JavaScript, Python, Java, C/C++, Ruby

Frameworks: React, JS, Django, Spring, Ruby on Rails

Databases: PostgreSQL, MySQL, Redis, MongoDB, Kafka

Cost to Develop Banking Software

Two major factors influence the total cost of developing banking software. One is the number of features and their complexity. For developing internal banking software, you need a few basic features like logging attendance and generating reports. To develop a retail customer-facing banking software, you need more features like giving access to bank accounts and opening bank accounts, etc. The cost of developing such an app will be higher. The second factor is the location of software developers. If you hire a software developer from the USA or Europe, your cost will be 5 to 6 times more than you hire developers from India. The difference is seen in their hourly wages.

Hence, the cost of building enterprise software for banks will be between $30000 to $130000.

Final Thoughts

Banks are now depending a lot on software to cater to their basic banking needs. Developing banking software needs complex procedures and developers cannot overlook a single smallest mistake. This can spoil the bank’s reputation. At Whitelotus Corporation, we carry more than a decade of experience in creating best-in-class IT mobile app development and banking software development solutions for our clients worldwide. We have a team of highly competent developers who welcome different fintech app ideas for startups. They are all ready to brainstorm around your complex problems and provide a robust solution. We have the needed expertise and proficiency to develop top-notch enterprise banking software. Get in touch with us today!

FAQs

1. What are the ways to build banking software?

Our team at Whitelotus Corporation has great expertise in building robust mobile banking software. We can guide you in all the phases of software development starting from research and planning to building prototypes and UI/UX designing to choosing the best tech-stack. We have a dedicated team of developers with perfect knowledge related to banking and other rules, regulations, and guidelines.

2. What are the challenges in adopting fintech technology in banks?

There are a few challenges along with bringing the benefits of fintech technology to the table. They are protection and security of user data, complying with regulations, meeting user expectations, getting the right development partner, and adopting latest trends.

3. What is the cost of building mobile banking software?

Typically, the cost ranges between $20000 to $40000 for basic apps. For banking software with advanced features, you can add up to $10000. However, the final cost relies on several factors like advanced tech stack, design complexity, developers’ location, and types of platforms you need. Other non-technical aspects that may be considered are the documentation process, types of accounts, and much more.

Author

-

Sunil is a result-orientated Chief Technology Officer with over a decade of deep technical experience delivering solutions to startups, entrepreneurs, and enterprises across the globe. Have led large-scale projects in mobile and web applications using technologies such as React Native, Flutter, Laravel, MEAN and MERN stack development.

View all posts