With the quick digitization of financial services, there is a huge demand for fintech apps. Consumers have high expectations for fast and easy access to mobile apps for money management. Essential skills like loaning money, trading stocks, processing payments, and more are needed to remain competitive.

Fintech app development solutions handle extremely sensitive user data and financial transactions, so robust security and scalability are essential. Additionally, seamless expandability is essential to the sector’s exponential adoption growth. Great innovation, however, comes with great responsibility.

Through the implementation of mindful methods, any finance app development business may achieve a sustained edge to lead disruption in this crucial domain by purposefully engineering security, scalability, and core functionality from early architecture decisions through launch and beyond.

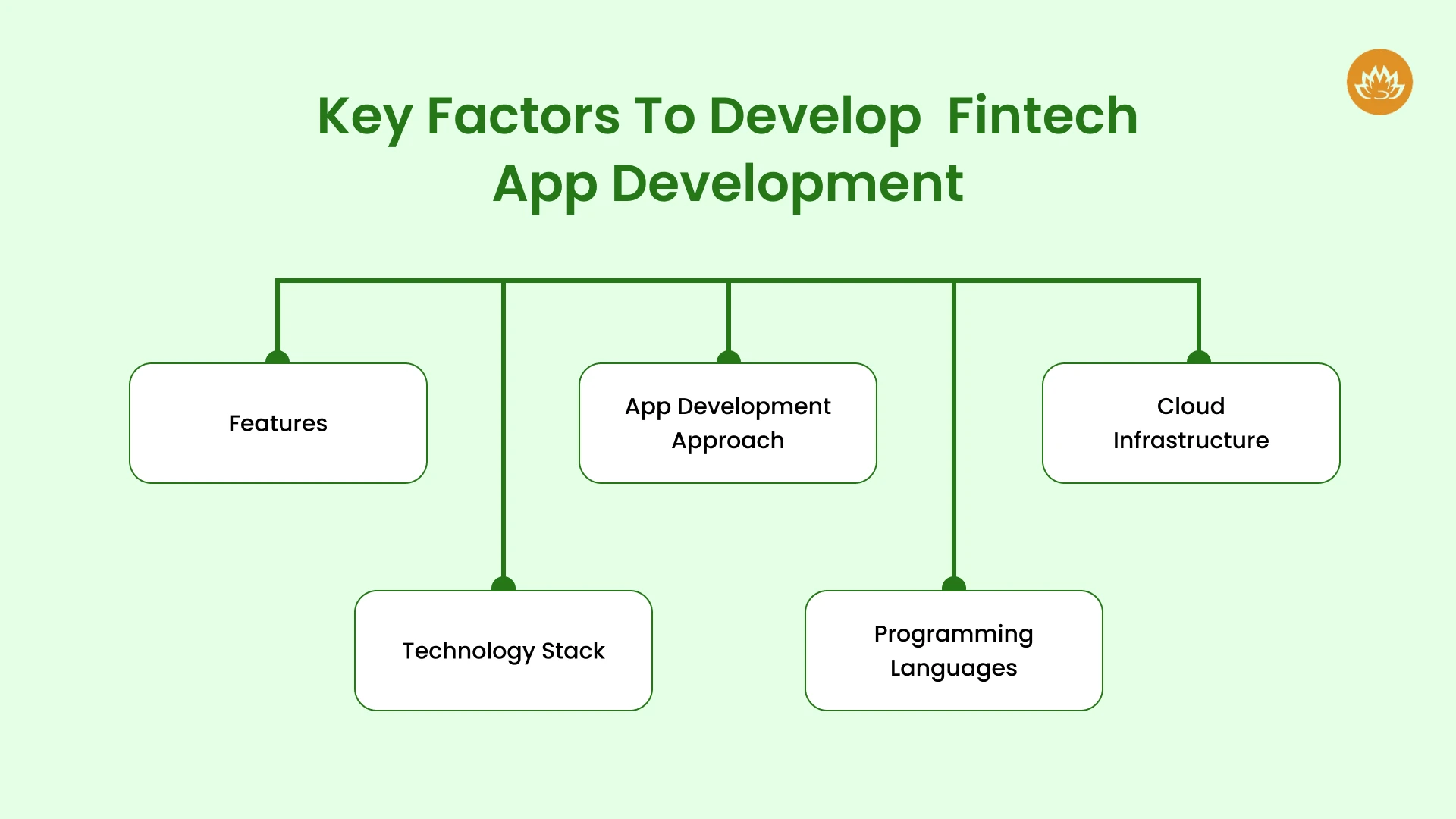

Factors Considered When Building A Fintech App

Features

Designing a successful financial app starts with a thorough grasp of your target market’s unmet demands. Next, identify the essential features and capabilities that will become their go-to solution, attract users fast, and foster long-term commitment.

Consider developing a cutting-edge cryptocurrency exchange app, for instance.

Capabilities include staking incentive programs for specific assets, smooth connectivity between users’ current cryptocurrency wallets and exchanges, extremely user-friendly desktop and mobile dashboards that show balances and market data, and more. To optimize early on, keep track of key user processes, such as user registration and verification, initial cryptocurrency deposits, initial trades, and withdrawals.

Technology Stack

Peak financial app speed, security, and efficiency as usage increases need careful selection of development languages, frameworks, and cloud architecture.

App Development Approach

Native, Hybrid, or Web App Model: Native apps optimize development for the target platform, such as iOS or Android, allowing maximum speeds.

However, installing platforms separately increases the expense significantly. The hybrid approach provides a compromise by employing cross-platform web programming languages to create fintech apps and packaging them in platform-specific wrappers. Although native performance may lag, faster iteration can reduce the cost. With conventional web programming languages, web apps offer the quickest spin-up, but they are limited in their ability to deliver more sophisticated functionality compared to native and hybrid approaches.

Programming Languages

Making important decisions for front-end and back-end development To manage analysis, transactions, connections with external systems, and other tasks, sophisticated server-side logic is made possible by popular backend languages like Java, Python, and Ruby. React Native is becoming popular for developing banking apps, while JavaScript frameworks offer responsive and user-friendly front-end user interfaces.

Cloud Infrastructure

Enabling Compute Scale, Storage, and Security: Cloud platforms such as AWS, Azure, and Google Cloud offer financial apps a strong infrastructure that includes growing server resources to meet demand surges, increasing storage capacity, and implementing security measures.

Better future-proofing results from making well-informed decisions here based on developer experience, app requirements, and the best community support.

How To Architect Fintech Apps Strategically For Affordable Scaling

Fintech apps must provide flexible scaling to handle adoption spikes without experiencing performance bottlenecks or incurring excessive infrastructure costs. Growth is unlocked cost-effectively by carefully optimizing design for effective resource use. This enables smaller businesses and startups with tighter finances to prepare for surges in demand. The strategies can be considered:

Horizontal Scaling

Expanding capacity as needed is made easy using cloud platforms to spin up more computing machines. As the number of daily active users or transactions increases over time, appropriately sized increments strike a balance between costs and performance. Set automatic server expansions as a top priority to maximize spending.

Vertical Scaling

Instead of continuously over-provisioning, scale vertically by enhancing server sizes and processing capability in a targeted way during recognized consumption spikes. Adaptable capability expansions within budgetary limits are made possible by combining sporadic vertical expansion with horizontal scale effects.

Database Sharding

Database sharding is a technique for intentionally dividing items among numerous databases. As fintech data storage needs grow, this technique decreases the demands on individual servers. Fast parallel access is still possible, while smaller servers manage portions of larger data pools.

Load Balancing

Utilizing supplied servers to their full potential before requiring the addition of more capacity is achieved by distributing application workloads among available computational resources. In addition to saving money, smart load balancing increases speed.

Microservices

Fintech apps can be more easily updated or scaled by dividing them into distinct microservices, which separate important features like user authentication or transactions into separate deployable pieces. Capacity can then be added specifically for the services that need more significant resources.

Step By Step Guide to Build a Secured Fintech App

Below are the steps you should implement when you want to build a secured and scalable fintech app. You can hire dedicated developers from a reputed mobile app development company for your innovative project. Gaining a competitive edge after developing a fintech requires understanding these fintech software development concepts. Let’s learn the stages involved in creating a fintech application.

Define Market Needs and Target Audience

Determining the market needs and target audience is the most important step to take before beginning to develop a fintech app. Find out what your target market requires by conducting in-depth research so that you can provide them with the appropriate product to meet their needs. Finding your target audience’s financial issues is crucial, as is monitoring your competition to see what holes they cannot fill.

You will clearly understand a niche after doing extensive study, such as blockchain solutions, fintech lending apps, personal finance management, or payment processes. Given the size of the fintech sector, you can customize your fintech software to target your target audience’s needs specifically.

Conduct Deep Market Research

To create a successful fintech app that will delight your users and help you gain a firm foothold in the market, you must comprehend the needs and preferences of your target audience. For market research, potential clients can be interviewed, focus groups can be held, and surveys can be used.

You will learn some important things about their needs from this procedure. In addition, evaluate current goods and services to determine what works and what doesn’t. In addition to saving you time, this research will give you a clear image.

Find Fintech Software Requirements

To determine the scope and requirements of your fintech app, you must thoroughly understand the fintech market. After completing the market study, you must choose from the scopes and needs we have listed.

- List every essential feature you wish to include in your application. Create a framework that provides for all the features, then rank each according to user requirements.

- Next, decide which tech stack will best support your financial software's performance, security, and scalability. The most popular options that many people employ are Java, Python, and Blockchain. Also, integrating AI in fintech is essential.

- You must ensure that your software conforms with the GDPR, AML, and KYC standards and laws pertinent to the financial industry. You can operate successfully and smoothly with this procedure.

Hire Dedicated Developers for Fintech App Development

The development stage follows all of the document work. You must hire mobile app developers because they are the foundation of every app development effort. The success of your application is dependent on the development team you select. You must assemble a development team of project managers, security experts, quality testers, designers, and developers.

Design UI/UX of the Software

An eye-catching component of any application is its design. It draws people to your application and keeps them glued to their screens while they use it. You must partner with an experienced ui/ux design firm as it is crucial to build wireframes and prototypes that highlight the user journey. To ensure a seamless experience, you must maintain your design’s accessibility, consistency, and simplicity. It offers a customized user experience and enhances the app’s interface.

Start Fintech App Development

Once the requirements and design layouts have been determined, you must begin developing your application. For managing the development process, it is essential to work with a financial software development business that is proficient in agile approaches.

When developing the program, the user interface must be responsive and visually appealing. It should offer an intuitive user experience that facilitates navigation. Your app will be perfect when you integrate third-party services like payment gateways and financial data suppliers.

Implement Powerful Security Measures

We’ve already talked about how important security is for finance software. Since you are working with consumers’ financial information, it should be part of the application. Businesses should safeguard user data and transactions by incorporating strong security measures into fintech app development.

You can strengthen your security system by putting these three security facets into practice. These elements include frequent audits, multi-factor authentication, and encryption. These security measures are necessary to stop data theft and leaks.

Test Fintech App

Once a FinTech application is created, it is tested to ensure it is flawless before deployment. Testing guarantees that your application is dependable and prepared to operate faultlessly in various scenarios. Testing for certain conditions can be done in a variety of ways. Some of the best ways are unit testing, integration testing, user acceptance testing, and performance testing.

Launch and Manage Fintech Application

The financial software development is prepared for release once all tests have been completed. You must pick a trustworthy hosting provider with strong security features and flexibility. All you have to do after the software launches is manage your application.

Keep an eye on your financial app’s performance to identify and fix problems quickly. To determine where your software needs to be improved, compile all user input. To prepare it for upcoming changes, keep the software updated.

What is the Cost to Build a Fintech App?

The cost to build a fintech app ranges between $50,000 and $500,000. Project complexity, the technology stack, the development team, the timeline, and post-deployment support are some of the variables that affect the development, though.

Since launching a fintech app can lead to establishing a fintech firm, the cost of developing a fintech app is also the answer to the question of how much it costs to start a fintech business. To construct an app and discuss the project, you must work with a fintech software development business. The cost estimate will aid your budget planning.

Conclusion

Businesses must build fintech software in order to remain competitive in the challenging market. We have covered the essential features, advantages, and step-by-step instructions to help you comprehend how developing a fintech program can improve your company. One of the best mobile app development company in India and USA, Whitelotus Corporation, has has extensive knowledge and experience creating cutting-edge FinTech applications. Our fintech specialists are adept at resolving any security issue. Therefore, you should collaborate with us right now if you intend to develop a cutting-edge fintech application.

Author

-

Kirtan is CEO of Whitelotus Corporation, an emerging tech agency aimed to empower startups and enterprises around the world by its digital software solutions such as mobile and web applications. As a CEO, he plays key role in business development by bringing innovation through latest technical service offering, creating various strategic partnerships, and help build company's global reputation by delivering excellence to customers.

View all posts